Remittances and economic growth: Evidence from Ethiopia, Kenya and Uganda

There has, in recent years, been a growing consensus amongst migration scholars and economists around the connection between diaspora and economic development. Yet, only a few studies have actually examined this connection, and their results have not always been conclusive. In our latest edition of the African Human Mobility Review, a joint effort with the University of Western Cape, we published Mulatu F. Zerihun’s research paper titled “Remittances and Economic Growth: Evidence from Ethiopia, Kenya and Uganda” (1). In his research, Zerihun analyses the possible effect of remittances sent by international migrants on the economic growth of three African countries of the Intergovernmental Authority on Development (IGAD): Ethiopia, Kenya and Uganda. Zerihun’s study was conducted based on the World Bank’s annual data from 1990 to 2017 prior to the 2020 pandemic. His quantitative study demonstrates that international remittances do have a long-term impact on the economic growth of the countries studied. Yet, the impact of remittances is not optimal and countries need to design appropriate policies to capitalize on remittance inflows for their economic development.

What are remittances?

According to the World Bank’s definition, remittances are the current private transfers from migrant workers resident in the host country for more than a year, irrespective of their immigration status, to recipients in their country of origin (2). Remittances are one of the major sources of capital inflow in the world, and occurs mainly through informal channels in Africa. International migrants send remittances for two main reasons: altruism, in assisting their family to meet basic needs, and self-interest, as they are expecting inheritance or ensuring that their assets back home are properly taken care of.

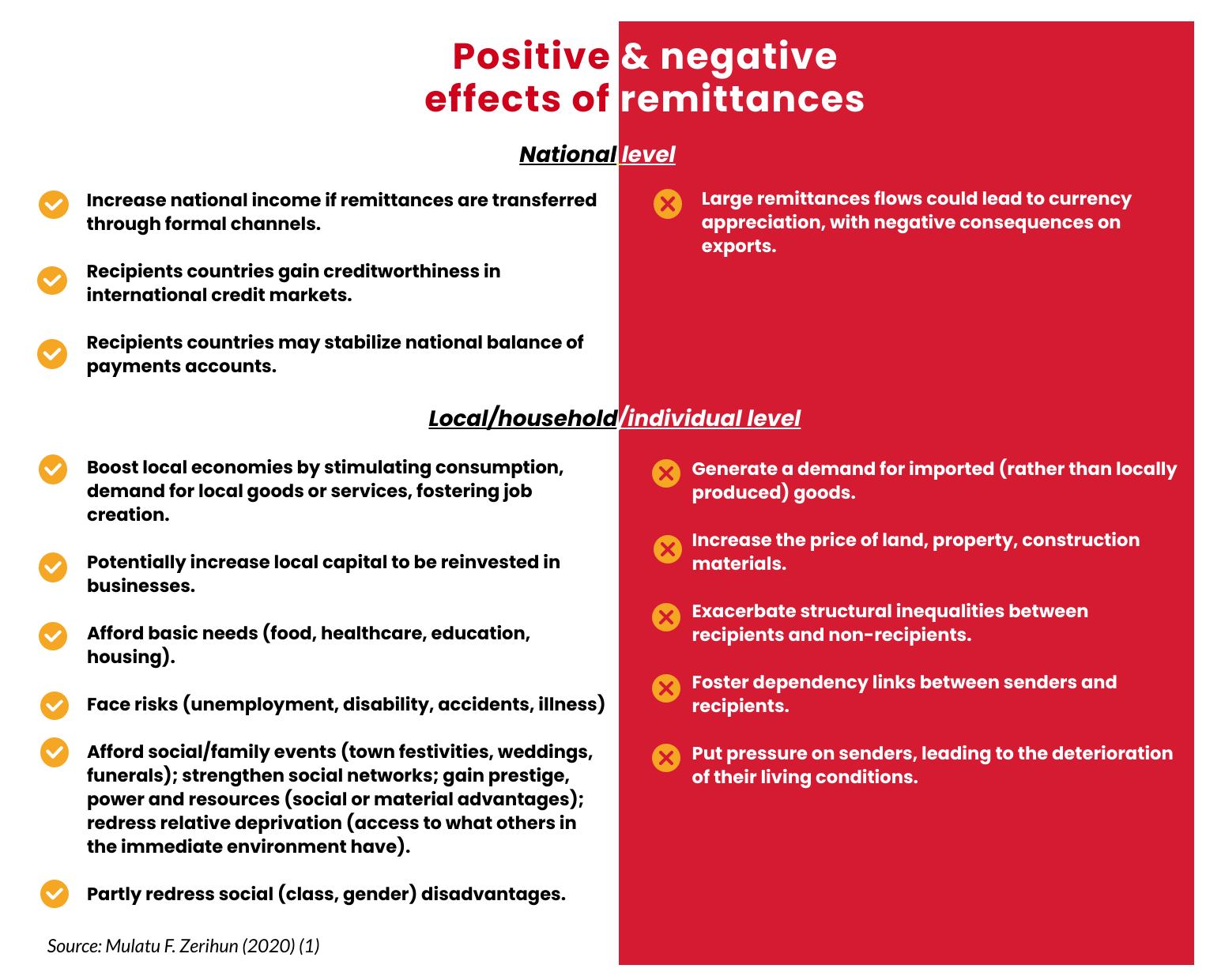

At the household level, remittances play a key role in helping households to afford basic needs and move out of poverty, increase education, health, and housing spending, to face and respond to risks and crisis etc. Remittances also have a social value, as receiving households can gain prestige, power and social advantages connected to having an additional source of income. In some cases, remittances can play a positive role in reducing existing social, class or gender disadvantages on the labour market.

At the national level, remittances are a more sustainable source of foreign currency for developing countries than other capital inflows, such as a foreign direct investment, public debt or official development aid. Ethiopia, Kenya and Uganda are amongst the top recipients of remittance inflows in East Africa. Indeed, according to some sources, the volume of remittances in Ethiopia could be between US$2 billion and 4 billion per year (3) (4).

Do remittances only have a positive impact?

Sadly, remittances are not the goose that lays golden eggs. Remittances can have a negative impact both at the national and local level, especially without regulation.

As Zerihun explains, the growing consumption of remittances’ recipients may lead to increased local market price and currency appreciation, with negative consequences on exports and jobs. At the individual level, remittances present a risk of exacerbating inequalities between recipients and non-recipients, create dependency between senders and recipients, increase the price of land, property and construction materials and generate a demand for imported goods instead of locally produced ones. In host countries, the pressure put on migrants to send remittances can also lead to deteriorated living conditions.

Do remittance inflows foster economic growth?

Zerihun’s study finds a positive connection between remittances and economic development. In other words, remittances do foster economic growth in the long-term in Ethiopia, Kenya and Uganda. However, the results of the study are not overwhelmingly sufficient to predict that remittances will continue to encourage economic development in the future.

Sub-Saharan Africa’s efforts at harnessing the benefits of remittance inflows are behind other regions. This is due to poor governance, lack of economic and political stability, trust deficit between the diaspora and the government, and unfavourable investment regulation that deters the inflow of remittances. For instance, complicated formal banking procedures and their cumbersome requirements make the lives of Ethiopian migrants in South Africa very difficult and almost all Ethiopian migrants in South Africa are unable to send money through formal channels and remit informally, as they do not have the required official identification and thus lack access to formal financial services (5).

Zerihun’s study shows how sub-regional analysis can help framing corridor-specific policy interventions related to remittance inflows. The author argues for the ‘big push’ theory which states that if remittances are managed properly and if smooth inflow is facilitated, remittances can jumpstart economic development in many African countries.

Countries must remove barriers related to costs, regularity and capacity to send money back home. Potential solutions may include issuing official identification to nationals living abroad, irrespective of their migratory status, to encourage them to use formal money transfer channels, as it was introduced in Mexico (1). Good relationships with the diaspora must be sustained and governments in remittance-receiving countries must ensure that their emigrants are recognised by the host country and provided with a good quality of life.

For more information on remittances on the African continent consider other AHMR papers:

African Migrants’ Characteristics and Remittance Behaviour: Empirical Evidence from Cape Town in South Africa – AHMR August 2018

Harnessing Economic Impacts of Migrant Remittances for Development in Sub-Saharan Africa: A Critical Review of the Literature – AHMR Jan-Apr 2017

An Evaluation of the Determinants of Remittances: Evidence from Nigeria – AHMR May- August 2015

James Chapman and Nolwenn Marconnet

SIHMA SIHMA

Project Manager Research and Communication Intern

Resources

- Zerihun, M. F. 2020. Remittances and Economic Growth: Evidence from Ethiopia, Kenya, and Uganda. African Human Mobility Review, 6(3). https://sihma.org.za/journals/1.%20Remittances%20and%20Economic%20Growth%20AHMR%203:2020.pdf

- World Bank. 2019. Leveraging economic migration for development: A briefing for the World Bank Board. Washington DC: World Bank.

- Isaacs, L. 2017. Scaling up formal remittances to Ethiopia: The executive summary of a research study to enhance the volume and value of formal remittances to Ethiopia. Regional Office for the EEA, the EU and NATO, International Organization for Migration, Brussels, Belgium. https://www.iom.int/sites/default/files/press_release/file/iom-ethiopia-executive-summary-21.pdf

- Adugna, G. 2019. Migration patterns and emigrants’ transnational activities: Comparative findings from two migrant origin areas in Ethiopia. Comparative Migration Studies, 7(5). https://www.researchgate.net/publication/331168474_Migration_patterns_and_emigrants%27_transnational_activities_comparative_findings_from_two_migrant_origin_areas_in_Ethiopia

- Dinbabo, M.F. 2020 (forthcoming). Ethiopian diasporas in South Africa: Dynamics of migration, opportunities, and challenges. In Gulema, S.B., Girma, G. and Dinbabo, M.F. (eds.), Global Ethiopian Diaspora.

Photo by Sincerely Media on Unsplash

Categories:

Tags: